Ntropy MCP Server: Enriching Banking Data for Smarter AI Agents

In the rapidly evolving landscape of AI-driven applications, the quality and context of data are paramount. The Ntropy MCP (Model Context Protocol) server, now seamlessly integrated with the UBOS platform, provides a powerful solution for enriching banking data, enabling AI Agents to make more informed and accurate decisions. This document outlines the key features, use cases, and benefits of using the Ntropy MCP server within the UBOS ecosystem.

What is the Ntropy MCP Server?

The Ntropy MCP server acts as a crucial bridge between AI models and financial data. It leverages the Ntropy API to enrich transaction data with detailed contextual information, transforming raw financial records into insightful, actionable intelligence. By providing AI Agents with this enriched data, the Ntropy MCP server enhances their ability to understand financial behaviors, detect anomalies, and provide personalized recommendations.

At its core, the MCP (Model Context Protocol) is an open standard designed to streamline how applications provide context to Large Language Models (LLMs). Think of it as a universal translator, allowing AI models to access and interpret data from diverse sources. The Ntropy MCP server embodies this principle by providing a standardized way for AI Agents to understand the nuances of financial transactions.

Key Features of the Ntropy MCP Server

The Ntropy MCP server offers a range of features designed to simplify the process of enriching banking data and integrating it with AI Agents:

- Account Holder Creation: The server provides a

create_account_holdertool, enabling you to create account holders within the Ntropy API. This tool requires essential information such as ID, type, and name, ensuring accurate and consistent account representation. - Transaction Enrichment: The

enrich_transactiontool is the heart of the server, allowing you to enrich transaction data with detailed contextual information. This tool requires key transaction details such as ID, description, date, amount, entry type, currency, and account holder ID. An optional country parameter allows for further localization and accuracy. - Seamless Integration with UBOS: The Ntropy MCP server integrates seamlessly with the UBOS platform, allowing you to easily deploy and manage it within your AI Agent workflows. This integration simplifies the process of connecting AI Agents with enriched financial data.

- Open Protocol Compliance: Adhering to the MCP standard, the server ensures compatibility and interoperability with various AI models and platforms. This open approach fosters innovation and collaboration within the AI community.

- Simplified Deployment: The server can be easily deployed using

uvx, a tool that simplifies the process of running and managing applications. This streamlined deployment process allows you to quickly integrate the Ntropy MCP server into your existing infrastructure.

Use Cases for the Ntropy MCP Server

The Ntropy MCP server unlocks a wide range of use cases across various industries:

- Fraud Detection: By enriching transaction data with contextual information, AI Agents can more accurately identify fraudulent activities, such as suspicious transactions or unusual spending patterns. The enhanced data provides a more comprehensive view of each transaction, enabling AI to detect anomalies that would otherwise go unnoticed.

- Personalized Financial Advice: AI Agents can leverage enriched transaction data to provide personalized financial advice to customers. By understanding their spending habits, income, and financial goals, AI Agents can offer tailored recommendations on budgeting, saving, and investment.

- Credit Risk Assessment: Financial institutions can use the Ntropy MCP server to improve their credit risk assessment models. By incorporating enriched transaction data, AI Agents can gain a more accurate understanding of an individual’s financial behavior and ability to repay loans.

- Customer Segmentation: The server can be used to segment customers based on their financial behavior. By analyzing enriched transaction data, businesses can identify distinct customer segments with unique needs and preferences, allowing them to tailor their products and services accordingly.

- Automated Accounting: AI Agents can automate accounting tasks by leveraging enriched transaction data to categorize transactions, reconcile accounts, and generate financial reports. This automation streamlines accounting processes, reducing manual effort and improving accuracy.

- Enhanced Know Your Customer (KYC) Compliance: By enriching transaction data with contextual information, the Ntropy MCP server can help businesses comply with KYC regulations. The enhanced data provides a more comprehensive view of each customer, enabling businesses to verify their identity and assess their risk profile more effectively.

Integrating with UBOS: A Powerful Synergy

The true potential of the Ntropy MCP server is unlocked when it’s integrated with the UBOS platform. UBOS is a full-stack AI Agent development platform designed to empower businesses to build, orchestrate, and deploy AI Agents across various departments. The combination of Ntropy’s data enrichment capabilities and UBOS’s AI Agent orchestration features creates a powerful synergy that drives innovation and efficiency.

Here’s how the integration works:

- Data Enrichment: The Ntropy MCP server enriches banking data using the Ntropy API, adding contextual information to each transaction.

- AI Agent Orchestration: UBOS orchestrates AI Agents, connecting them with the enriched data from the Ntropy MCP server.

- Automated Workflows: AI Agents leverage the enriched data to perform various tasks, such as fraud detection, personalized financial advice, and credit risk assessment.

- Continuous Learning: The AI Agents continuously learn from the enriched data, improving their accuracy and efficiency over time.

With UBOS, you can:

- Orchestrate AI Agents: Seamlessly manage and coordinate multiple AI Agents to perform complex tasks.

- Connect with Enterprise Data: Integrate AI Agents with your existing data sources, including the Ntropy MCP server.

- Build Custom AI Agents: Develop custom AI Agents tailored to your specific needs and requirements.

- Leverage Multi-Agent Systems: Create sophisticated AI systems that combine the capabilities of multiple AI Agents.

Getting Started with the Ntropy MCP Server on UBOS

Integrating the Ntropy MCP server with UBOS is a straightforward process. Here’s a step-by-step guide:

Obtain an Ntropy API Key: Create an account on ntropy.com to obtain an API key.

Install the Ntropy MCP Server: Use

uvxto run the Ntropy MCP server, providing your Ntropy API key as a parameter:bash uvx run ntropy-mcp --api-key YOUR_NTROPY_API_KEY

Configure Claude Desktop (Optional): If you’re using Claude Desktop, add the following configuration to your

claude_desktop_config.jsonfile:“mcpServers”: { “ntropy-mcp”: { “command”: “uvx”, “args”: [ “ntropy-mcp”, “–api-key”, “YOUR_NTROPY_API_KEY” ] } }

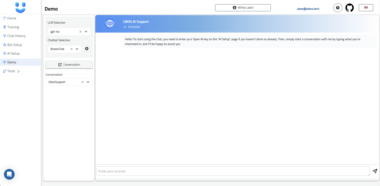

Connect to UBOS: Configure your UBOS AI Agents to connect to the Ntropy MCP server.

Start Enriching Data: Begin enriching transaction data and leveraging it within your AI Agent workflows.

Conclusion

The Ntropy MCP server, when combined with the UBOS platform, provides a powerful solution for enriching banking data and empowering AI Agents. By providing AI Agents with detailed contextual information, the Ntropy MCP server enhances their ability to understand financial behaviors, detect anomalies, and provide personalized recommendations. This integration unlocks a wide range of use cases across various industries, driving innovation and efficiency. Embrace the future of AI-driven financial solutions with the Ntropy MCP server and UBOS.

Ntropy MCP Server

Project Details

- smithery-ai/ntropy-mcp

- Last Updated: 2/24/2025

Recomended MCP Servers

This read-only MCP Server allows you to connect to Airtable data from Claude Desktop through CData JDBC Drivers....

Fork of Neo4j MCP server with environment variable support

A First FIWARE Model Context Protocol Server

Enables AI agents to manage issues, projects, and teams on the Linear platform. MCP server.

Model Context Protocol Servers

Manage / Proxy / Secure your MCP Servers

From vibe coding to vibe deployment. UBOS MCP turns ideas into infra with one message.

From vibe coding to vibe deployment. UBOS MCP turns ideas into infra with one message.